- ATV accidents

- Brain Injuries

- Bus Accident

- Car Accidents

- Construction Accident

- Distracted Driving

- Drugged Driving Accident

- DUI

- Firm News

- Mass Tort

- Medical Malpractice

- Motorcycle Accidents

- Pedestrian Accidents

- Personal Injury

- Product Liability

- Safety

- Social Security Disability

- Truck Accidents

- Vehicle Accidents

- Workers Compensation

- Workplace Injuries

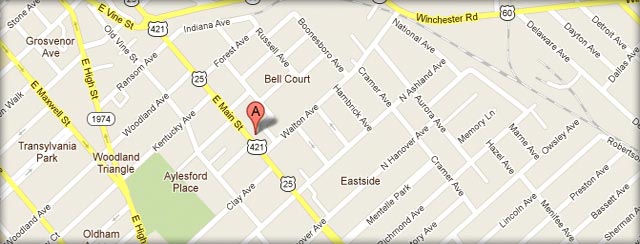

For more information about car accidents, see our page Lexington car accident lawyer.

Kentucky is a unique state in that the government has taken it upon itself to rigorously prosecute drivers who chose to drive without insurance, contrary to the law of the state. Because of this strictly enforced policy there are some key points that all drivers, and vehicle owners in Kentucky should be aware of.

The Kentucky Legislature has mandated a crackdown on uninsured motorists across the Commonwealth.

Owners of personal vehicles shown to have been without insurance will receive notices that registrations for their personal vehicles will be canceled if they do not obtain required insurance or show proof of existing insurance.

The mandatory insurance initiative is aimed at plugging an enforcement gap that enables drivers to skirt the law by dropping coverage once their vehicles have been registered.

As long as the vehicle is registered (has a license plate), it must be insured. To avoid penalties for being uninsured, you must turn in your license plate to your County Clerk’s office. This is designed to assist law enforcement in identifying drivers that do not have insurance. Driving without a license plate is a quick way to get pulled over.

In the event that a vehicle owner drops their coverage and fails to report it as such, and further fails to submit their license plate to the County Clerk’s office their vehicle will be flagged in Kentucky’s Insurance System as being uninsured. A letter will be mailed to the owner’s residence instructing them to present proof of continuous coverage to the County Clerk.

Owners who have received such a letter may choose to ignore it, however, their registration will be cancelled. Operating a vehicle without a permit to do so and without insurance can result in strict penalties enforced by the county.

Kentucky law requires insurance companies registered with Kentucky to report all personal policies to the Division of Motor Vehicle Licensing once a month. This electronic report is a list of Vehicle Identification Numbers (VINs). If the VIN reported by the insurance company for a particular vehicle does not match the VIN on record with Motor Vehicle Licensing, the vehicle will be flagged as being possibly uninsured.

Owners of seasonal vehicles such as motorcycles or RVs are accustomed to dropping the insurance on these vehicles during the months they are not being driven. As long as the vehicle has a license plate, it is required by Kentucky law to maintain at minimum a liability insurance policy. To avoid penalties for a lack of insurance, the owners of these vehicles must turn in their license plate to the County Clerk’s office prior to cancelling their insurance policy. When it is time to put the vehicle back on the road, secure proof of insurance and present the proof to the County Clerk. At that time, the clerk’s office will allow registration of the vehicle.

An owner may not operate a vehicle in Kentucky until insurance has been obtained. An owner who fails to maintain insurance on his vehicle shall have his vehicle registration revoked according to statute. In addition, the vehicle owner as well as the vehicle driver are subject to a fine of $500 to $1000, up to 90 days in jail, or both. All owners of motor vehicles in Kentucky are required to carry minimum liability coverage. This means liability coverage of $25,000 for all claims for bodily injury damages sustained by any one person and not less than $50.000 for all bodily injury damages sustained by all persons as a result of any one accident, as well as $10,000 for all property damage as a result of any one accident. Alternatively, a policy with a single limit of $60,000 is acceptable. In addition, the policy must provide basic reparations benefits, unless the insured vehicle is a motorcycle.

The law requires that “before the owner of a motor vehicle or trailer may operate it or permit its operation upon the highways of this state, he shall obtain motor vehicle insurance… as required by KRS 304.39-080…” (KRS 186A.065 Prerequisites for operation of motor vehicles or trailers).

If you are hit by a driver with no insurance, you will have a claim against your own insurance company if you have an uninsured motorist policy. Your insurance company will “step into the shoes” of the driver that caused the motor vehicle collision and pay on your claim. If you have been involved in a car accident and the other driver had minimal insurance coverage ($25,000 per person / $50,000 per occurrence is the minimum coverage in Kentucky), you may have an underinsured motorist claim.

If you believe you have an underinsured motorist claim in Kentucky, call the Frank Jenkins Law Office today at 859-389-9344 for your free consultation!